Reps often report that marketing-qualified leads aren’t truly qualified. The responses? Dozens of sales professionals chimed in with the same advice: start asking better qualification questions early.

Top B2B reps don’t wait until the first sales call to qualify. They research ahead and then ask strategic questions that reveal genuine buying potential.

In this guide, we’ll walk you through the exact qualification questions to ask before and during your sales process, helping you close faster and eliminate the noise.

Why most sales reps are asking the wrong qualification questions

One common mistake: asking surface-level questions you could answer with 20–30 minutes of LinkedIn research.

Let’s take this scenario for example:

A rep jumps on a discovery call and asks:

“How many employees do you have?”

“Are you the decision-maker?”

The prospect answers politely but disengages. They want to know if you can solve the problem now.

And best believe, they feel you should have done your homework before asking those kinds of questions. In that moment, you’ve wasted time on both sides without confirming if there’s a real opportunity.

We’ve found that reps are relying solely on old-school lead qualification playbooks, such as the BANT framework, without establishing specific pain points.

BANT has guided qualification for decades, but it’s not enough on its own today.

Traditional qualification frameworks, such as BANT, often require sales representatives to ask questions that could be easily researched online.

When you ask, “How many employees does your company have?” or “What’s your job title?” you waste valuable conversation time on information that’s readily available on LinkedIn. Asking for a prospect’s budget makes sense, but what happens when you are limited to just BANT?

Poor qualification wastes time and pipeline. Other hidden costs include:

- Spending 60 minutes on calls that better prep could cut in half, especially by mapping the decision-making process upfront

- Bloated pipeline metrics from unqualified prospects

- Missed quota due to time spent chasing leads without decision-making power

- Frustrated teams watching deals collapse late from poor early qualification

The modern approach to qualifying sales leads

B2B qualification has shifted: do the research upfront, then use the call to uncover complex factors. The sales qualification process now operates on two levels: automated pre-qualification using available data and strategic conversation-based qualification for complex decision factors.

Pre-qualification research answers basic qualification criteria before conversations:

- Company size and growth indicators suggest budget capacity: Instead of asking, “What’s your budget?” review LinkedIn company pages for headcount trends, recent hiring, and funding signals.

- Job titles and team composition signal decision-making authority: You don’t need to ask “Are you the decision-maker?” Use LinkedIn to map roles, then confirm in the call. PhantomBuster’s automations can compile the list so you can validate quickly.

- Recent company news and LinkedIn activity reveal pain points and urgency: Use PhantomBuster’s LinkedIn Search Export automation plus the AI LinkedIn Profile Enricher automation to collect public profile and company update signals, then analyze decision-maker engagement.

And when you’ve hit a block on research, that’s where conversation-based qualification comes in. Chris Orlob paints it perfectly when he posted this PSA for salespeople.

Here are prompts to guide conversation-based qualification:

- Instead of guessing whether the company has a budget after doing diligent research, you’re asking how spending decisions are made based on available financial resources.

- Instead of asking who signs off, you’re mapping out internal friction and figuring out how priorities shift between teams, or using multi-threading to reach out to multiple decision-makers within the company, because the average B2B deal now involves between seven and 10 decision-makers. That number grows when selling into the C-suite because the B2B buying process isn’t linear.

- Instead of sticking to a rigid framework, you tailor the conversation to what they already know and what they still need to uncover.

With this process, you’ll spot potential roadblocks early and focus on prospects who are ready to buy.

Essential qualification questions by category

We have established why you should ditch generic qualification questions. The most effective sales qualifying questions uncover the information that determines whether prospects become customers.

Start here: These five must-ask questions will help you quickly assess fit before diving deeper.

- “Walk me through your current process for [relevant business area]”

- “What’s the biggest challenge you’re facing with your current approach?”

- “Who else is involved in evaluating solutions like this?”

- “What’s driving the timeline for this project?”

- “What other solutions are you evaluating?”

Now, let’s break down the full catalog of qualification questions by category:

1. Need and pain point discovery questions

Pain points drive the sales process. Without genuine pain points, prospects lack motivation to change their current situation, regardless of your solution’s capabilities.

Primary pain discovery questions:

- “Walk me through your current process for [relevant business area]”

- “What’s the biggest challenge you’re facing with your current approach?”

- “What happens if you don’t solve this problem in the next quarter?”

- “How is this challenge impacting your team’s performance metrics?”

Then go deeper to understand urgency and internal pressure:

- “Have you tried solving this before? What happened?”

- “What’s the cost of not addressing this issue?”

- “How does this problem affect other departments?”

These sales qualification questions help you understand the underlying business impact driving the prospect’s evaluation process.

Pro tip💡: Review recent LinkedIn posts and company updates to spot what the prospect values and where they’re stuck. Then ask targeted questions to confirm fit.

2. Budget and financial impact questions

Bringing up the budget too early can feel transactional. But skipping it entirely? That’s how deals fall apart at the finish line.

Instead, tie the budget to the problem they’ve already admitted to having. The more painful the problem feels, the more natural it is to discuss what it’s costing them.

Financial impact questions:

- “What’s the financial impact of the problem you’re describing?”

- “How do you typically measure ROI for initiatives like this?”

- “What’s the cost of your current solution, including hidden costs?”

Once they’ve acknowledged the value of solving it, shift into budget mechanics:

- “Have you already set aside a budget for this?”

- “How do budget approvals typically work on your team?”

- “Who’s involved in budget decisions?”

And if the conversation opens up, you can test for alignment:

“Teams your size usually invest around [$X–Y] for this. Does that track with your expectations, or are there any financial constraints?”

3. Authority and decision-making process questions

In most B2B deals, there’s rarely one person calling the shots. Decisions move through buying committees, side influencers, and internal politics. To single-thread this process is to put all of your sales eggs in one basket, which is risky and unnecessary.

Decision-maker identification questions:

- “Besides yourself, who else is involved in evaluating solutions like this?”

- “Who would be the final decision-maker on this purchase?”

- “What role does [IT/Finance/Legal] play in decisions like this?”

- “Who are the day-to-day users who should be part of this conversation?”

Then shift to how the process works:

- “What does your typical purchasing process look like for software like this?”

- “What criteria are most important to your team when making decisions like this?”

- “What approval steps are required before you can move forward?”

And don’t stop at the org chart. Get a sense of the internal dynamics:

- “Who’s likely to champion this?”

- “Who might push back on switching from your current system?”

- “What other teams would be affected by this rollout?”

- “Has anyone successfully led a project like this before?”

These questions help you uncover decision patterns, so you don’t just chase a name on a title. You build a strategy around the real stakeholders.

4. Timeline and urgency questions

Use timeline questions to separate near-term opportunities from longer-term nurture, so your forecast stays accurate.

Understanding urgency helps prioritize your sales efforts and forecast accurately.

Urgency driver questions:

- “What’s driving the timeline for this project?”

- “Are there any upcoming deadlines or events that make this urgent?”

- “When do you need to start seeing results from a new solution?”

Then assess where this ranks against everything else on their plate:

- “What other priorities are competing for your attention right now?”

- “How does solving this problem rank among your team’s current initiatives?”

- “What would need to happen for this to become a higher priority?”

Finally, validate the logistics:

- “What’s a realistic implementation window on your side?”

- “How long do evaluations like this usually take?”

- “When would you need to have a contract signed?”

- “Are there any seasonal or business cycles we should factor in?”

5. Solution fit and requirements questions

Just because a prospect has a problem doesn’t mean your solution is the answer. Fit comes down to how well your product maps to their specific needs and how prepared they are to implement it.

Requirements discovery questions:

- “What are your must-have requirements versus nice-to-haves?”

- “Are there any technical requirements or integrations we should know about?”

- “What does your current technology stack look like?”

- “What compliance or security requirements do we need to consider?”

Then get clear on what success actually looks like from their perspective:

- “How do you measure success for projects like this?”

- “What are your key metrics for the first 90 days?”

- “How will you know this is working?”

6. Competition and alternatives questions

Competitive qualification shows where you stand in their evaluation. You’re probably not the only vendor they’re considering. Seek to know how they’re comparing options.

Competitive landscape questions:

- “What other solutions are you evaluating?”

- “How did you create your vendor shortlist?”

- “What’s most important to you when comparing different options?”

- “Have you seen demos from other vendors? What stood out?”

Then look backwards to see what they’re moving away from:

- “What do you like about the current solution you are using, and what’s not working?”

- “What would convince you to stick with your current approach?”

And don’t forget the non-obvious competition: doing nothing.

- “If you don’t go with any vendor, what’s your fallback?”

- “Have you considered building this in-house?”

- “What happens if this gets delayed until next year?”

- “Who is your current provider?”

How to pre-qualify sales prospects using LinkedIn data (before your discovery call)

Every productive sales conversation starts before the rep ever says a word. The research you do ahead of time determines whether you spend the call uncovering fundamental deal drivers.

Andy Mewborn, founder of distribute.so, ran a quick poll, and the results weren’t surprising: 51% of salespeople believe you should spend 30–45 minutes researching a prospect before the first call.

When done right, this research surfaces what you actually need to know: company, role, recent triggers, tech stack, timing and urgency, and potential pain triggers.

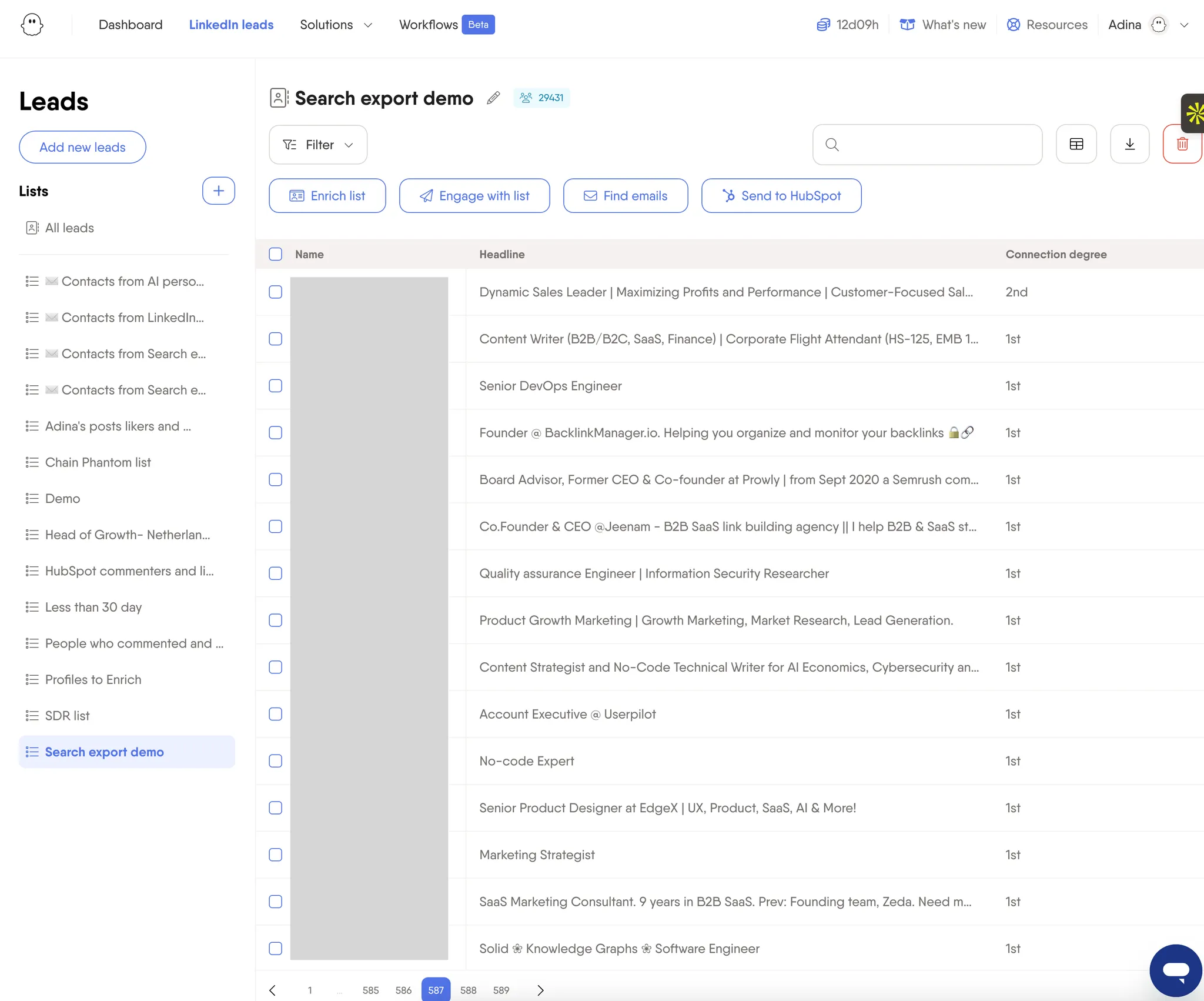

Below are practical ways to pre-qualify prospects with LinkedIn data, plus the PhantomBuster automations that make the research repeatable at scale.

Company size and growth qualification

Use PhantomBuster to pull company page data and flag headcount growth, then prioritize accounts where expansion signals budget and urgency.

Authority and influence mapping

LinkedIn profiles and team pages reveal roles, tenure, and likely reporting lines you can use to infer decision-making hierarchies. Review team members’ titles, tenure, and backgrounds to identify potential decision-makers, influencers, and end-users before your first conversation.

Use PhantomBuster to compile stakeholders, then confirm roles in the call.

Pain point indicators

Posts, shares, and company updates often hint at real business problems: growth pains, process gaps, market changes. These signals help you tailor your outreach and discovery questions around what’s actually top of mind.

Helpful workflow💡:

Use PhantomBuster’s LinkedIn Search Export automation to pull profiles that match keyword searches. Pair it with the AI LinkedIn Profile Enricher automation to summarize public activity related to topics like “compliance” or “scaling.” This helps you find leads already thinking about the problems your product solves.

Technology stack assessment

LinkedIn profiles and company pages mention technology usage, certifications, and tool preferences. This information helps assess solution fit and identify integration requirements before conversations begin.

Timing and urgency signals

Recent job changes, company announcements, funding news, or regulatory deadlines visible on LinkedIn can indicate buying urgency. These signals help prioritize prospects who are more likely to move quickly through the sales process.

Pro tip💡: Use PhantomBuster’s AI LinkedIn Profile Enricher automation to score leads against your qualification criteria and prioritize outreach. We recommend using PhantomBuster’s AI LinkedIn Profile Enricher automation to generate lead scores based on your criteria. Use it responsibly: respect LinkedIn guidelines, set conservative volumes, and keep outreach personalized.

Qualification conversation best practices

- Start with open-ended context questions: Begin by exploring their current process or situation to surface pain points without sounding scripted.

- Let responses guide your follow-ups: Build each question from the last. Stay flexible and dig deeper based on what they say, rather than what your framework dictates.

- Frame qualification as value-driven: Position questions as a way to help them, not vet them. Use phrasing that ties questions to solving their challenges.

- Share insights while you qualify: Offer relevant examples, trends, or mini-case studies as you go. It builds credibility and keeps the conversation two-sided.

- Nurture promising but mistimed prospects: Stay in touch with good fits who aren’t ready. They might be tied to a contract, be in the early stages of growth, or lack internal buy-in.

- Keep outreach personalized and within LinkedIn’s guidelines: Use automation to prep and enrich, not to mass-message.

Multi-channel qualification strategies

Different communication channels require adapted qualification approaches. The same prospect may respond differently to LinkedIn messages, emails, and phone conversations.

| Channel | Best Practices |

| • Focus on one key qualification point per message • Ask specific, profile-based questions • Keep it brief and conversational • Reference mutual connections or shared context | |

| • Include 2–3 targeted qualification questions • Use clear subject lines with intent • Offer easy ways to self-qualify via responses • Add a Calendly link for deeper conversation scheduling | |

| Phone Calls | • Prepare 3–5 qualification questions based on research • Let the conversation flow naturally • Take detailed notes for follow-up • Confirm mutual interest and next steps before closing |

Measuring and improving your qualification process

Effective sales qualification requires continuous measurement and optimization. Track key metrics like:

- Qualification-to-opportunity rate: Tracks how many qualified leads become actual pipeline deals.

- Qualification accuracy: Shows how often qualified leads end up closing.

- Time to qualify: Measures efficiency from first contact to qualified status.

Then use optimization strategies like:

- Review recorded calls: Spot patterns and missed signals in real conversations.

- Use A/B-tested questions: Experiment with two versions and track response quality.

- Analyze closed-won deals: Identify traits and patterns shared by successful leads.

- Track disqualified leads: Learn what often leads to slowdowns, ghosting, or stalls.

- Enrich CRM data: Add firmographic and behavioral insights to improve qualification scoring.

Common qualification mistakes to avoid

Even experienced sales reps make qualification mistakes that waste time and hurt deal progression. Avoid these common errors to improve your sales pipeline.

Pre-call research mistakes

- Asking questions you could’ve answered with LinkedIn or company pages

- Skipping recent activity, job changes, or funding announcements

- Ignoring PhantomBuster automations that enrich prospect data at scale (e.g., LinkedIn Search Export + AI LinkedIn Profile Enricher)

Conversation mistakes

- Following rigid scripts instead of adapting to the conversation

- Bringing up the budget before establishing value

- Missing key buying signals by not listening actively

Process mistakes

- Over-qualifying and making the call feel like an interrogation

- Advancing unfit leads without verifying core criteria

- Failing to document insights that support future touchpoints

Timing mistakes

- Trying to qualify everything in one conversation

- Overlooking urgency triggers like new hires or upcoming launches

- Rushing next steps without confirming true readiness

FAQ: Lead qualification questions

How many qualification questions should I ask in the sales funnel?

Quality beats quantity. Ask only what you can’t learn from research. Aim for 6–10 targeted questions per conversation, focused on gaps your research couldn’t answer. Well-qualified prospects typically require two to three conversations to understand their decision-making process and buying criteria fully.

When should you ask about the budget?

Ask about budget after you’ve established pain and value, often 15–20 minutes into the call. Start with financial impact questions before direct budget inquiries: “What’s the cost of this problem?” Then, “Have you allocated a budget for solving it?”

How do I qualify prospects on LinkedIn before making a call?

Review company size, recent hiring, technology mentions, and prospect activity for qualification signals. Look for expansion indicators, pain point discussions, and authority signals in their profile and posts. PhantomBuster automates pre-call research: export profiles, enrich with AI, and surface triggers so you can tailor discovery.

What if the prospect doesn’t seem ready to answer qualification questions?

Reframe questions as a way to help, with useful insights, rather than an interrogation. Offer a relevant insight or example, then ask a follow-up question that directly ties to their situation. If they remain vague or avoidant, that’s often a signal they’re not ready or not a serious lead.