Navigating lead generation as a financial advisor can be tricky. With so many methods available, it can be tough to know where to start.

In this article, we'll discuss some of the most effective strategies for financial advisors.

By the end, you'll have a handful of new tactics to boost your lead-generation efforts and attract more clients.

TL;DR

Cold calling, direct mail, and buying lead lists are traditional lead generation methods that don't convert well. Here are 11 top lead generation strategies for financial advisors:

-

Create a strong personal brand as a financial advisor by enhancing your LinkedIn profile, posting regularly, and engaging with your network.

-

Find potential clients with LinkedIn Sales Navigator using advanced search filters and personalized outreach to connect with ideal clients.

-

Do more social selling and less cold calling by automating social engagement, like commenting on posts, before sending connection requests or sales messages.

-

Segment your lead lists before reaching out and categorize potential customers based on their needs and interests.

-

Leverage intent data from social media to identify prospects actively seeking financial advice by tracking their engagement with relevant content and events.

-

Look at your competitors' social media profiles to analyze engagement patterns and reach out to their audience with tailored messages.

-

Test different sales cadences by experimenting with various outreach sequences to discover the most effective timing and methods.

-

Promote lead magnets with paid ads like LinkedIn Ads to share valuable content like eBooks, webinars, or checklists.

-

Run workshops and webinars to position yourself as an expert and engage directly with potential clients.

-

Try a lead automation tool like PhantomBuster to automate data scraping, personalized messaging, and CRM integration tasks.

-

Partner with a lead generation agency to outsource your efforts and receive high-quality leads.

1. Build a strong personal brand as the best financial advisor

Building a personal brand helps you inspire trust. Clients who see an authentic and consistent financial advisor feel more confident in your expertise.

First, optimize your LinkedIn profile:

-

Make your headline clear about what you offer.

-

Write a summary that shows your experience and skills.

-

Keep everything updated.

-

Get recommendations from clients and colleagues to boost your credibility as a financial advisor.

Next, post regularly and engage with your network. Share industry news, insights, and personal stories to show your expertise.

Respond to comments, ask questions, and join discussions to build relationships.

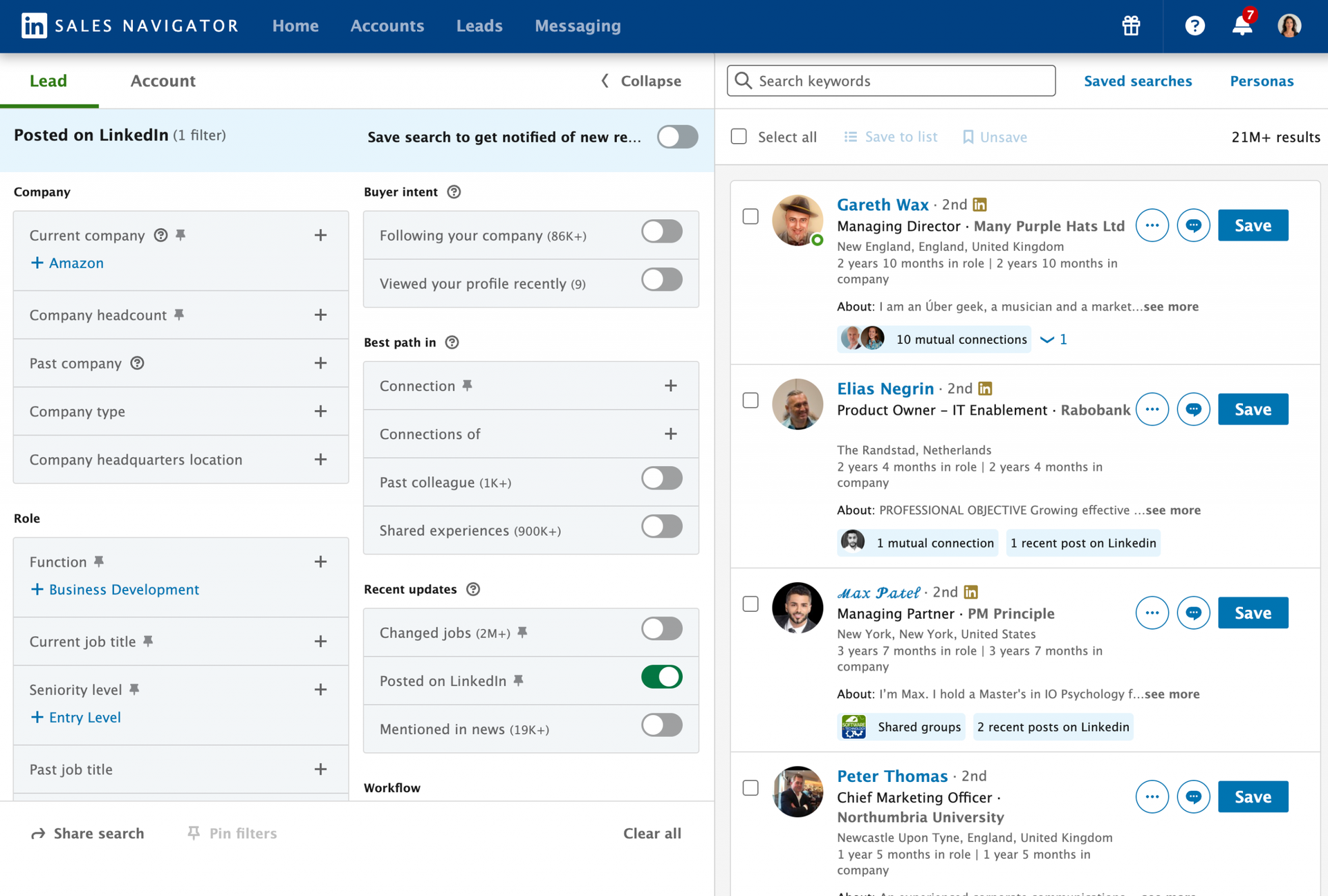

2. Use LinkedIn Sales Navigator to find prospective clients

LinkedIn Sales Navigator is a powerful tool for finding potential clients.

Why is it a great strategy for lead generation for financial advisors? Because it helps you pinpoint the right people quickly and accurately.

Start by using the advanced search filters.

You can filter by industry, company size, location, and more to find exactly who you need.

This way, you can build a list of qualified leads who are more likely to be interested in your financial advisor services.

Next, save your searches and create lead lists.

This keeps everything organized and lets you follow up quickly. Plus, Sales Navigator alerts you to updates like job changes so you can reach out at the perfect time.

Sales Navigator also offers great features for financial advisors like personalized outreach with InMail messages, insights from account pages to identify decision-makers, and team collaboration tools like TeamLink and SmartLinks.

3. More social selling, less cold calling

Social selling is a smart strategy for financial advisors because it helps build relationships before making a pitch.

It’s perfect to connect with potential clients in a less intrusive way, building trust and rapport first. Plus, this strategy fits well with building your financial advisor's personal brand and makes you more relatable.

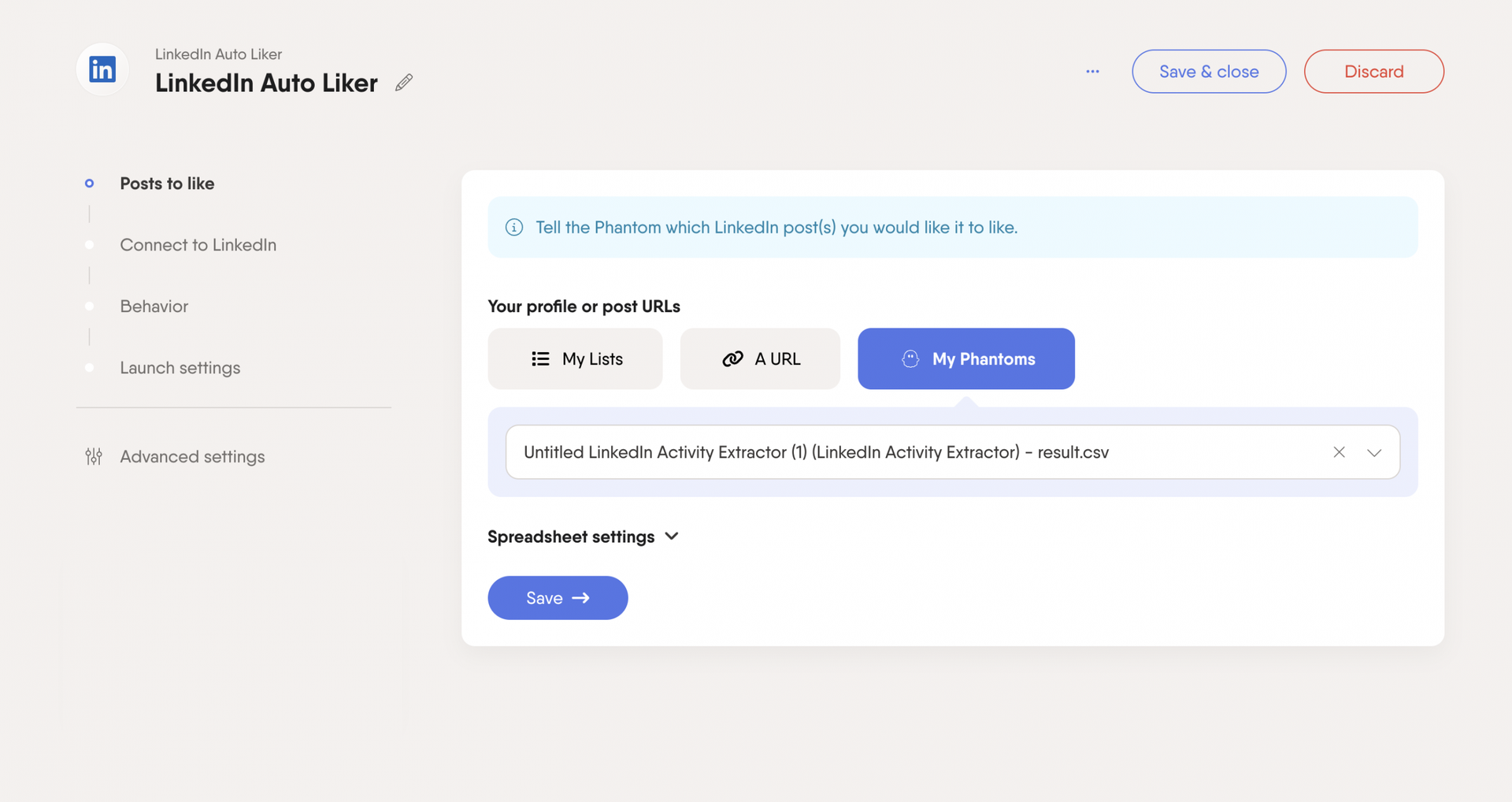

To effectively use social selling, start with automated engagement.

Tools like PhantomBuster can help you engage with potential clients by liking, commenting on, and following posts on LinkedIn.

This shows you really care and makes you seem more human.

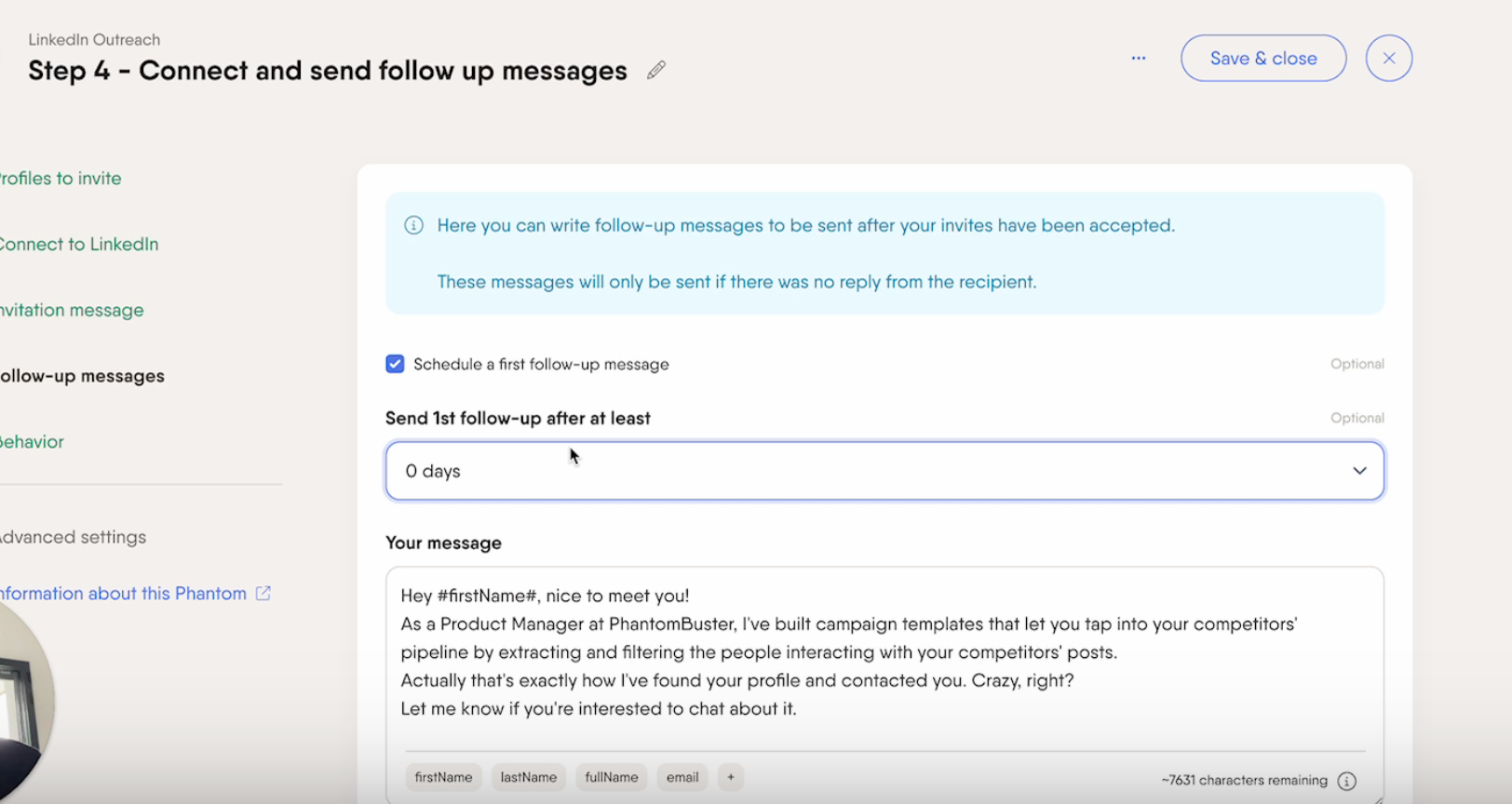

Once you've established initial engagement, automate your outreach.

Use the LinkedIn Outreach flow to automatically send connection requests and up to three follow-up messages.

This keeps your efforts consistent and saves you time so you can focus on what matters.

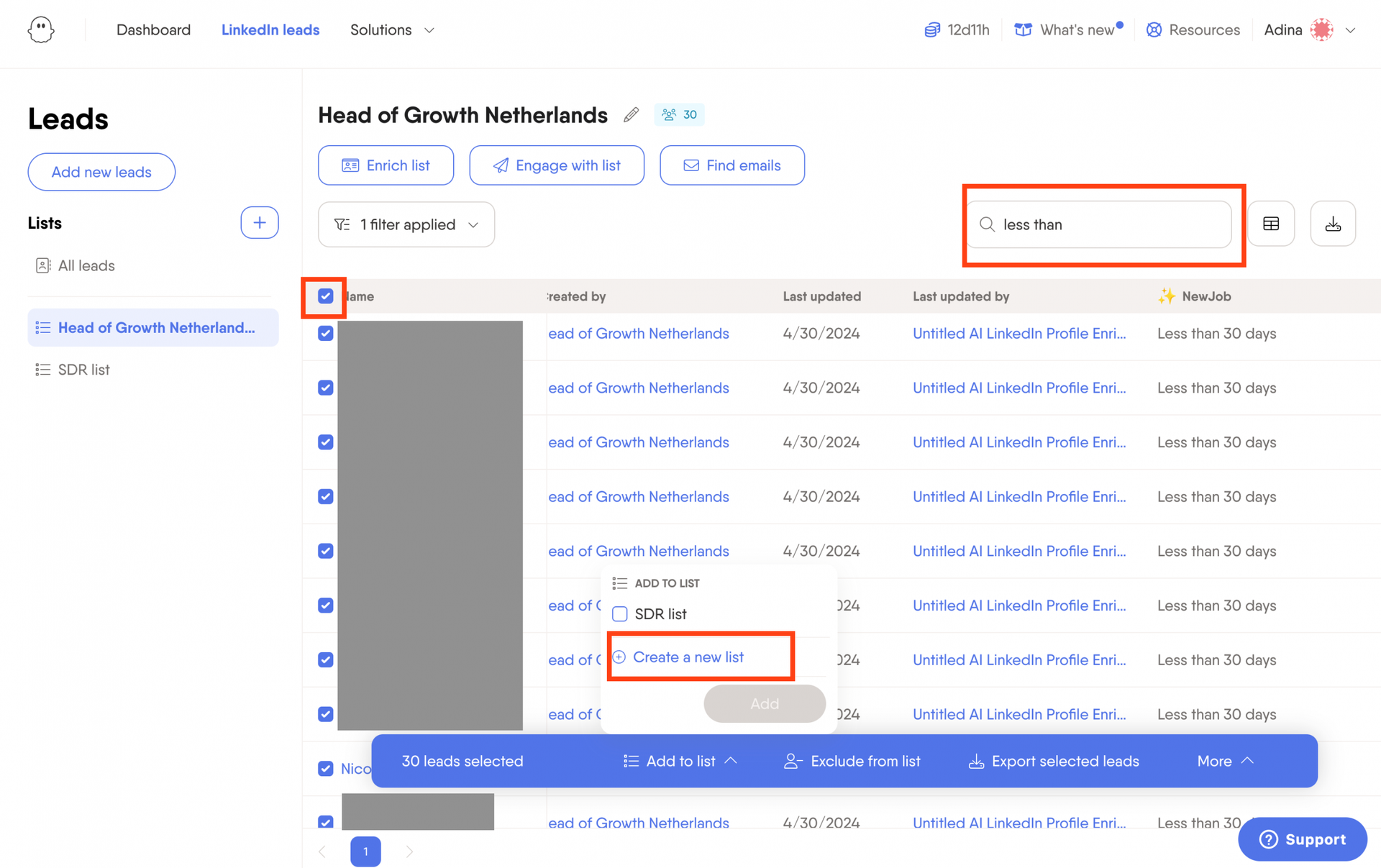

4. Segment your lead lists before reaching out

Segmenting your lead lists allows for more personalized approaches, which makes your lead generation more effective.

Tailoring your messages to your prospects' needs and interests can increase your chances of a positive response.

Here’s how to do it:

Enrich your lead lists by scraping LinkedIn data and using AI to identify recent changes, such as job transitions. For example, if a contact has changed jobs in the past month, you use that as a conversation starter, so let AI enrich your lead list with that info.

Then use the additional info to create different micro-lists.

By segmenting your leads this way, you can send targeted messages that resonate better, making your outreach more effective and increasing your success rate.

5. Leverage intent data from social media

Leveraging intent data from social media is a great strategy because it helps identify people who are actively looking for the help of a financial advisor or investment opportunities.

These individuals are often engaging with educational content, like webinars.

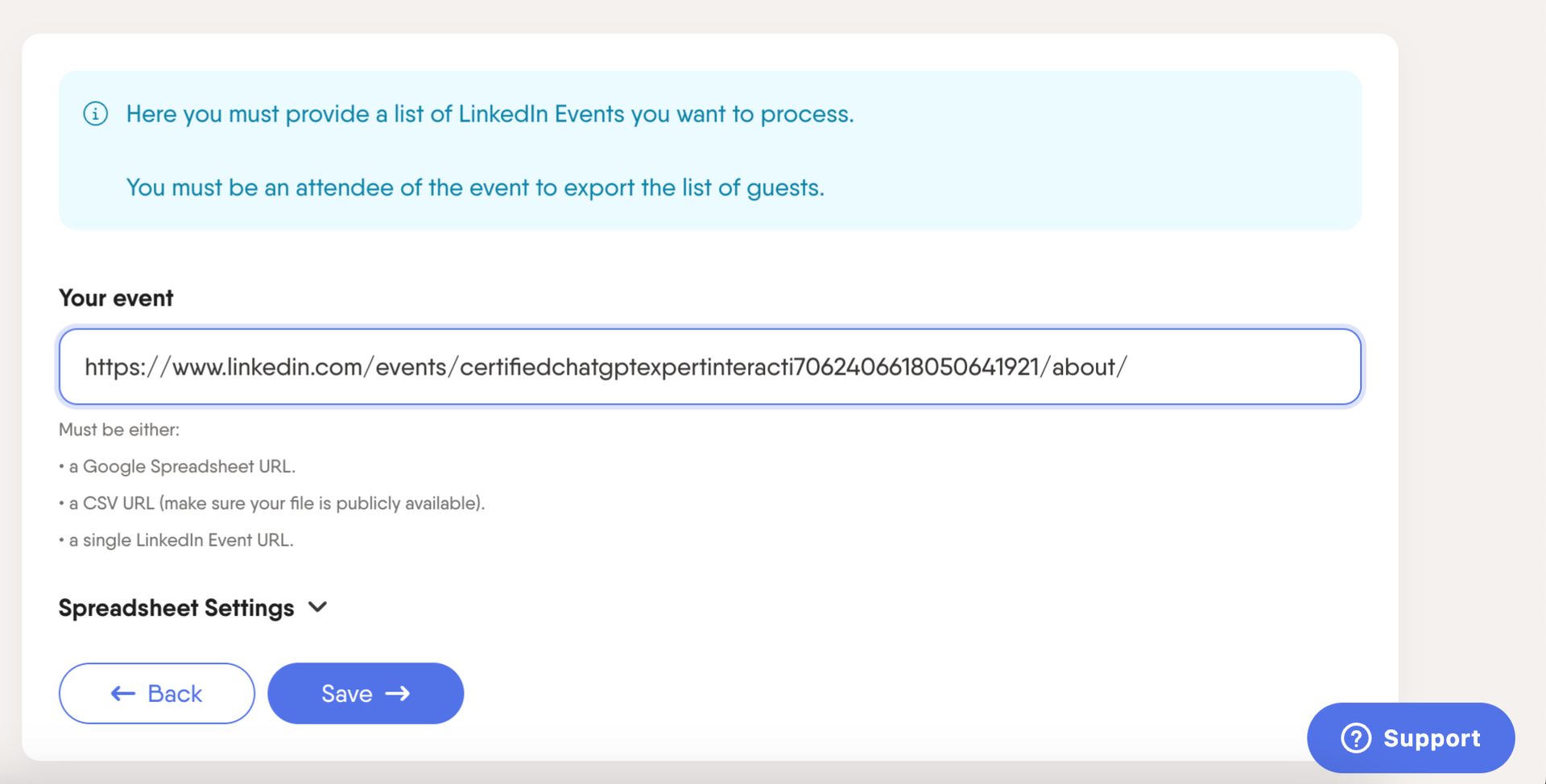

You can scrape and export attendees' data from a single LinkedIn Event URL. This gives you a list of qualified leads interested in a specific topic.

Once you have this list, use automation to engage with each lead.

Send personalized messages related to the event they attended. This helps you connect on a relevant topic, making your lead generation more effective and increasing the chances of a positive response.

6. Look at your competitors' social media profiles

Looking at your competitors' social media profiles is a smart strategy for financial advisors because it helps you understand what content works and who engages with it.

You can use this information to refine your approach.

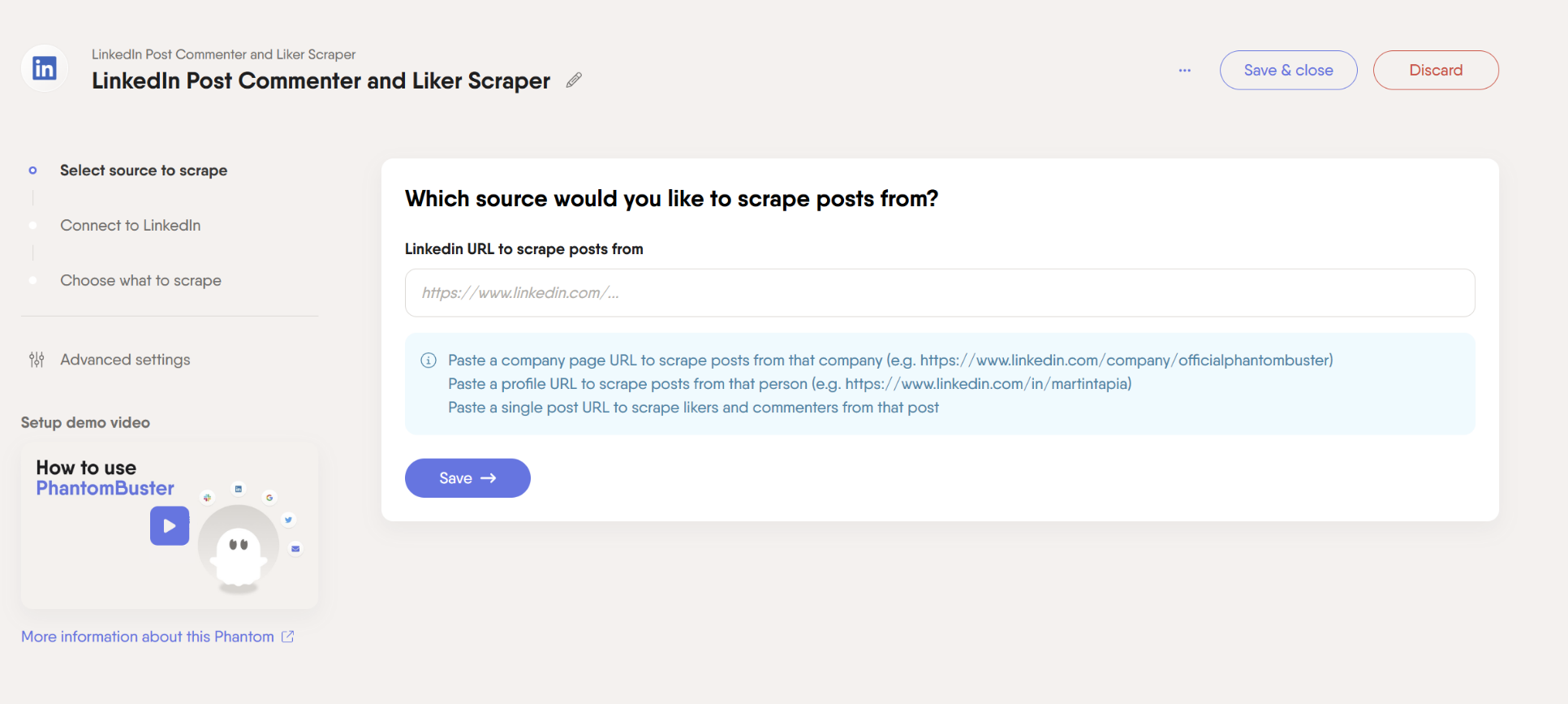

Start by scraping data from your competitors' LinkedIn posts. Tools like PhantomBuster's LinkedIn Post Commenter and Liker Scraper can help you scrape data on who liked or commented on their posts.

This gives you insights into their engagement patterns and audience.

This data lets you identify key trends and understand what resonates with your target audience. Then, you can reach out to these engaged individuals with tailored messages.

Warm leads already interested in similar content are more likely to engage.

7. Test different sales cadences

Testing different sales cadences helps you find the best way to connect with your prospects.

Here's a simple example:

LinkedIn Engagement and Pitch:

Day 1: Follow your prospect on LinkedIn.

Day 2: Like one of their posts.

Day 3: Comment on their post.

Day 4: Send a connection request with a personalized message.

Day 5: Share a valuable resource like an ebook or report.

Day 8: Pitch a personalized demo.

Try out different sequences and see what gets the best response.

Keep an eye on your metrics, like how many people respond or accept your connection requests, and tweak your approach to see what works best.

8. Promote lead magnets with paid ads

Lead magnets like eBooks, webinars, or checklists are perfect for attracting potential clients. These freebies offer value, and in return, you get their contact info.

Promoting lead magnets with paid ads is one of the most effective lead-generation strategies for financial advisors.

For example, with LinkedIn Ads, you can:

-

Promote an eBook or webinar with a catchy image in Single Image Ads.

-

Share downloadable guides directly in the feed with Document Ads

-

Showcase multiple features of your checklist or toolkit in a swipeable format using Carousel Ads.

-

Grab attention quickly with Video Ads—ideal for webinars.

-

Sends personalized offers directly to your audience with Sponsored Messaging.

These LinkedIn ad types help amplify your lead magnets' reach and attract high-quality leads.

9. Run workshops and webinars

When you host a webinar or workshop, you position yourself as an expert financial advisor. This builds trust and credibility with your audience. They see you as the go-to source for valuable financial advice.

Webinars and workshops are also great for direct interaction. You can answer questions and give personalized insights, making it more engaging.

It's a good way to make potential clients remember you when they need financial advice.

Promote these events on your website, social media, and email campaigns. By consistently providing value, you'll build a loyal following.

10. Try a lead automation tool

The right lead automation tool can make a big difference in lead generation for financial advisors. You can have a steady flow of clients without all the hassle.

Lead automation tools help financial advisors gather contact info from posts and send personalized follow-up messages, making it easier to build relationships.

With tools like PhantomBuster, you can handle much of the heavy lifting.

Automating engagement—liking, commenting, and following relevant profiles—keeps you connected with potential clients without manually interacting with each one.

You can scrape leads from LinkedIn and other sources, enrich your data, and automate LinkedIn outreach.

The AI lead enrichment feature can help you enrich your lead lists, making your outreach more effective.

PhantomBuster starts at $56 a month and has a free 14-day trial.

11. Partner with a lead generation agency

Partnering with a lead generation agency can be a great move for financial advisors.

They know the market inside and out and have proven prospecting methods to identify financial planner leads. They take care of outreach and follow-up for you, so you don't have to.

These can be pricey, but the ROI can be great for financial advisor lead generation. The quality of leads they provide will result in more clients.

Traditional lead generation methods (less effective)

Sometimes, the old ways just don't cut it anymore.

Here's a quick rundown of some traditional lead generation methods that aren't as effective as they used to be:

-

Cold calling: Most financial advisors receive many negative responses to cold calls. Combined with frustration, low success rates can lead to burnout.

-

Direct mail: Most recipients view direct mail as junk. It doesn’t target a specific audience, resulting in low conversion rates.

-

Newspaper and magazine ads: Unless placed in niche publications, these ads don't reach a specific audience, making them one of the least effective ways to target high-net-worth investors.

-

Buying lead lists: When financial advisors buy leads, they can be outdated or irrelevant. They often lack the personalization needed to convert leads into clients, leading to low engagement and conversion rates.

-

Trade shows and events: While networking at these events can generate financial leads, the high costs and time investment often don’t justify the results, especially when the target audience is not well-defined.

-

Billboards and outdoor advertising: These methods have a broad reach but lack the ability to target specific audiences, leading to a low return on investment for financial advisors.

Conclusion

Generating leads as a registered investment advisor doesn’t have to be overwhelming. With tools like LinkedIn Sales Navigator and PhantomBuster, financial advisors generate leads quickly and get better results.

Whether you're running webinars, automating outreach, or partnering with a lead generation agency, these strategies can help you attract more clients.

Try these tips with PhantomBuster and watch your client base grow!